oklahoma auto sales tax and fees

Multiply the vehicle price after trade-ins and incentives. Oklahoma also has a vehicle excise tax as follows.

New Vehicle Specials Farrish Chrysler Jeep Dodge

The Legislature removed the 125 of the exemption in 2017 but Sen.

. Take The Kids To School. The minimum is 725. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

325 percent of the purchase price. In Oklahoma this will always be 325. 125 sales tax and 325 excise tax for a total 45 tax rate.

Ad Shop for New Used Autos Online Get Delivery Straight to Your Door. Free Unlimited Searches Try Now. 20 on the first 1500 plus 325 percent on the remainder.

Used vehicles are taxed a flat fee of. Ad Get Oklahoma Tax Rate By Zip. Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price.

Oklahoma charges two taxes for the purchase of new motor vehicles. How much will my tag tax and title cost in Oklahoma. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

There is also an annual registration. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Auto Sales Tax information registration support. In Oklahoma this will always be 325. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Multiply the vehicle price before trade-in or incentives by the sales. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

OKLAHOMA CITY On Wednesday the Senate approved Senate Bill 1075 to reinstate the full sales tax exemption on motor vehicles and tractor trailers. The excise tax is 3 ¼ percent of the value of a new vehicle. Oklahoma has a lower state sales tax than 885.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Typically the tax is determined by. Ad New State Sales Tax Registration.

Multiply the vehicle price after trade-ins and incentives by the sales. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Multiply the vehicle price by the sales. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Kim David R-Porter said with revenues at record highs its time to restore the much-needed tax relief for Oklahomans. 20 up to a value of 1500 plus 325 percent on the remainder.

Our free online Oklahoma sales tax calculator calculates exact sales tax by state county city or ZIP code. The value of a vehicle is its. Check prior accidents and damage.

Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state. An example of an item that exempt from Oklahoma is. Things You Can Now Do At Home.

325 percent of purchase price. We are a network of over 300 independent state-appointed tag agents that work. Test Drive A Car.

The county the vehicle is registered in. We would like to show you a description here but the site wont allow us. The Oklahoma Vehicle Registration Fees and Taxes Act also known as State Question 691 was on the August 22 2000 ballot in Oklahoma as a legislatively referred state.

If I Buy A Car In Another State Where Do I Pay Sales Tax

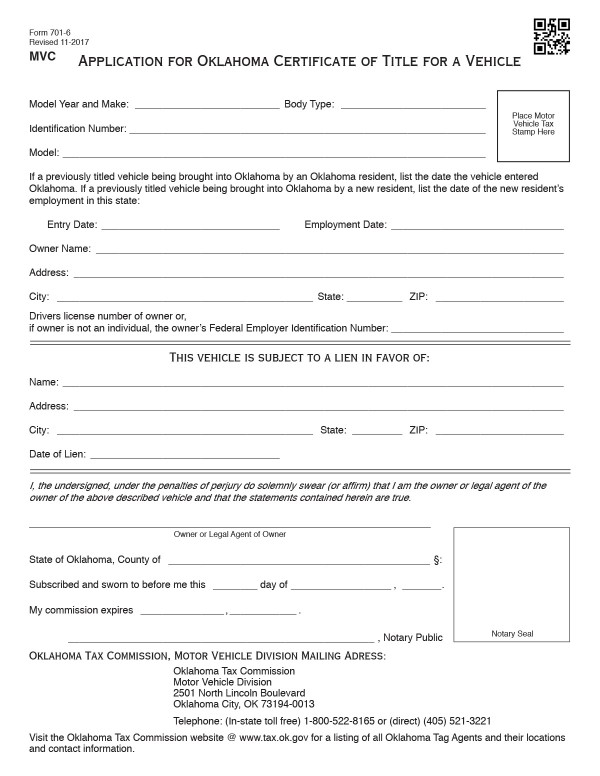

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNIIU3TZ6ZJ7XA6KSWPAXNFHMU.png)

Oklahoma Tax Commission Asking To Shut Down G W Zoo Over Unpaid Sales Tax

Colorado Sales Tax Rate Rates Calculator Avalara

Texas Used Car Sales Tax And Fees

Bills Of Sale In Oklahoma The Templates Facts You Need

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Car Tax By State Usa Manual Car Sales Tax Calculator

Used 2019 Nissan Rogue For Sale In Oklahoma City Ok With Photos Cargurus

Bob Howard Chrysler Jeep Dodge Ram Oklahoma City Dealer

Amendments Would Eliminate Oklahoma Grocery Tax While Raising Sales Gpt Tax Rates

949 Used Cars Trucks Suvs In Stock In Oklahoma City Bob Howard Chevrolet

63 New Buick Gmc Cars Trucks Suvs For Sale In Oklahoma City Ok

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)